Funko Falls Apart

Funko makes bobblehead dolls and collectibles. Its sales fell through the floor recently. The company is small, so it is a wonder the trouble was visible. However, Bob Iger, Disney’s new CEO, and media mogul Peter Chernin are large shareholders. The collapse triggered the firing of Funko’s CEO. Replacing him will not solve the problem.

Funko’s stock was worth as much as $27.79 during the last year. It currently trades at about $11. That price represents a bounce from less than $9 a few days ago.

Former CEO Brian Mariotti has been brought back, but that may well not drive a turnaround. Nevertheless, the company said new management would “strengthen the Company’s operations, drive enhanced returns for stockholders and best position Funko to capture the significant opportunities ahead.”

On the surface, Funko’s recently reported quarterly earnings were not terrible. Revenue hit $365 million, up 37%. Net income was less impressive as it dropped 39% to $11 million. The management that was just thrown out was ecstatic about the results. Then CEO Andrew Perlmutter said, “We delivered another quarter of record net sales growth, with robust demand across our brand portfolio. Our sustained success is a testament to our employees, our partners, and our loyal and highly engaged fan base.”

Get Our Free Investment Newsletter

Investors, however, were upset by forecasts of future earnings. Management said revenue would not grow at all during the holidays.

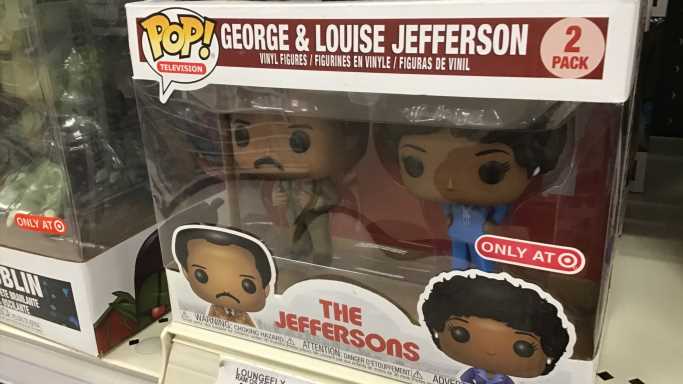

Funko might have an unsolvable problem. People may want to buy something other than its little dolls. These dolls are often based on fictional characters like Darth Vader and Coca-Cola Santa. The 10″ Darth Vader Lights & Sound – Star Wars costs $50.

So, the management change at Funko may not be the solution to its problems. Funko has not said people are tired of its dolls, although it may not know.

Funko is on the ropes, and that could be where it stays.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Source: Read Full Article