The Banking Accidents Have Started

The failure of SVB was due to idiosyncratic reasons, but shows how higher rates can expose fault lines in unforeseen places, observes Neelkanth Mishra.

Over the past several months, as interest-rate expectations have risen rapidly, we have worried about the risk of ‘accidents’ — failures of firms, which can freeze financial markets.

Economic forces are mostly self-adjusting — a rise in interest rates to fight inflation can slow the economy, and once inflation is lower, rates can fall again.

This is akin to us standing on a hill and planning to move to another hill: If all goes well, we can land at the same or better place.

The challenge is in crossing the valley in between.

As former Fed chairman Ben Bernanke wrote in a 2018 paper, the 2008 slowdown might have been much shallower than it was if a financial market panic had not occurred.

Is the failure of Silicon Valley Bank (SVB) such an accident?

SVB’s failure had idiosyncratic drivers.

Its undiversified depositor base made it more susceptible to runs (a few e-mails from venture capitalists to their investee firms sufficed) and had a large proportion of uninsured deposits.

It had also seen remarkable volatility in deposit flows: First a sharp rise from $56 billion before Covid to $173 billion at the end of 2021, and then a sharp drawdown as start-ups used their cash due to a funding crunch.

As their customers did not need as many loans, the deposits were parked in ‘safe’ securities: These holdings rose from $28 billion to $125 billion, purchased mostly at abnormally low yields.

While these bonds did not have any risk of default, they were still exposed to interest-rate risks (bonds fall in value as interest rates rise).

These losses initially remained on paper, but became manifest when the bank had to sell the bonds to service customer requests for deposit withdrawals. This concern was what drove the bank run.

These factors were specific to SVB and may not hurt other banks as much.

Further, regulatory intervention over the weekend to assure depositors at SVB (and Signature Bank in New York, which faced similar challenges) that their deposits are safe should suffice to prevent runs at other banks.

However, the US banking system is still exposed to significant losses on their bond portfolios.

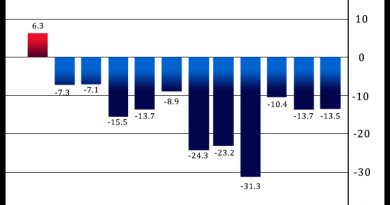

Their holdings of ‘safe assets’ (government bonds and mortgage-backed securities, or MBS) climbed rapidly from $3 trillion in 2019 to $5 trillion in 2021 and, despite some selling and a fall in value, are still $4.2 trillion.

The Federal Deposit Insurance Corporation (FDIC) calculated unrealised losses on these portfolios to be $620 billion in December 2022.

Around half of this would be on bonds marked ‘hold to maturity’ (HTM), implying the bank does not expect these to be sold before their maturity date (the other half is ‘available for sale’or AFS, whose value is marked to market).

However, when liquidity becomes tighter, the distinction between AFS and HTM fades in relevance. Unrealised losses on HTM portfolios are nearly 12 per cent of US banks’ equity.

The US Fed’s quantitative tightening (QT) is also hurting these portfolios.

Yields on US-government bonds have risen, but those on MBS have risen even faster.

The gap between government-bond yields and MBS yields rose to a 40-year high as the Fed stopped buying MBS.

As a result of the failure of SVB, the market now expects slower rate hikes from the Fed, with the end-2023 Fed funds rate expectations falling by nearly 60 basis points (0.6 per cent) in a day.

This means that the Fed’s commitment to its 2 per cent inflation target will be tested, and a weakening of that resolve would have far-reaching consequences for global financial assets.

For emerging markets (EMs), while lower future rates generally mean easier monetary conditions, that may not be the case now, given that these are driven by a significant rise in uncertainty.

Perhaps more importantly, SVB may not be the last accident caused by the sudden increase in interest rates and a tightening of money supply after a decade of easy monetary conditions.

Corporate debt-to-GDP ratios in developed markets are significantly above 2010 levels, because sustained low rates changed the optimal capital structure, supporting more debt on corporate balance sheets than earlier possible.

Low rates also drove up the share of BBB-rated issuers (the lowest investment-grade rating) from 32 per cent in 2012 to 50 per cent now.

Such borrowers are affected disproportionately by higher rates; even if they do not default, if lenders cut back, it slows the economy further.

For now, the bigger risk in 2023 is not from failed debt rollovers (this may be a bigger issue in 2024), but from rating downgrades that can push these borrowers down into speculative/junk grade, which is un-investible for insurance and pension funds, triggering self-reinforcing downward spirals.

Sustained low rates had also allowed many zombie firms (defined as firms that cannot service their interest costs from their operating profits) to survive.

Their persistence may be tested by interest rates staying higher for longer, and their failures, if bunched together, can be destabilising.

Eroding wealth too is a headwind: Whereas the rise in the global wealth-to-GDP ratio between 2002 and 2007 was driven by accelerating growth, the much sharper rise between 2010 and 2021 can be attributed largely to low interest rates.

Wealth provides buffers during financial shocks and supports the risk appetite of firms and individuals.

The erosion of wealth due to higher rates, through lower P/E multiples for equities, for example, or weak real-estate prices in markets with slow growth/weak demographics, can potentially trigger self-reinforcing cycles of corporate and household deleveraging.

The rise in real-estate prices from 2019 to 2021 was the highest in 30-50 years in several major markets (like the US, Australia, Canada, and Germany).

Real estate being the most potent channel for monetary transmission, higher rates are now driving real-estate prices lower.

Two potential risks emerge: First, slower economic growth, as house construction has a large share in GDP in most markets, and, second, stress in the financial sector, because home loans are 30-60 per cent of banking-system loans in major markets, and around a fifth of such loans have loan-to-value ratios above 80 per cent.

At this stage we worry more about growth slowdown than financial-system stress, but we worry that markets like Germany, Canada, and Australia have not seen a real-estate downturn for 20 years, and their financial systems are not stress-tested.

India’s dependence on foreign capital makes it vulnerable to accidents in the global financial system, which can suddenly stall dollar inflows.

Policymakers are rightly being cautious in their approach as the world navigates what is likely to be a turbulent year.

Neelkanth Mishra is co-head of APAC Strategy for Credit Suisse

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article