Federal Investigations into Binance Have Pushed the Cryptocurrency Bearish Trend Deeper

The world’s largest cryptocurrency exchange Binance Holdings Ltd. is facing serious investigations by the Internal Revenue Service and the U.S Department of Justice after being accused of facilitating illegal activities related to digital currencies.

The federal investigations on the exchange have caused the price of its own cryptocurrency Binance Coin (BNB) to fall by over 10% and many other coins including Bitcoin (BTC) that were being traded on this exchange have been affected.

The watchdog has been collecting information from the public regarding the Exchange’s business dealings and to ascertain whether there are possible money-laundering plus tax-related illegitimate activities done by both crypto-asset users or staff of the exchange.

More than 300k individual accounts at Binance and Huobi got Bitcoin from illicit sources

The investigations into the matter comes a few days after Chainalysis reported that more than $756 million worth of illegal Bitcoin were spread via the Binance crypto exchange. The report revealed that over $2.8 billion worth of illicit BTC from criminal entities went through exchanges and trading platforms in 2019, of which 50% went to Binance (27.5%) and Huobi (24.7%). Just more than 300k individual accounts at the two exchanges above, Binance and Huobi, received BTC cryptocurrency from criminal entities.

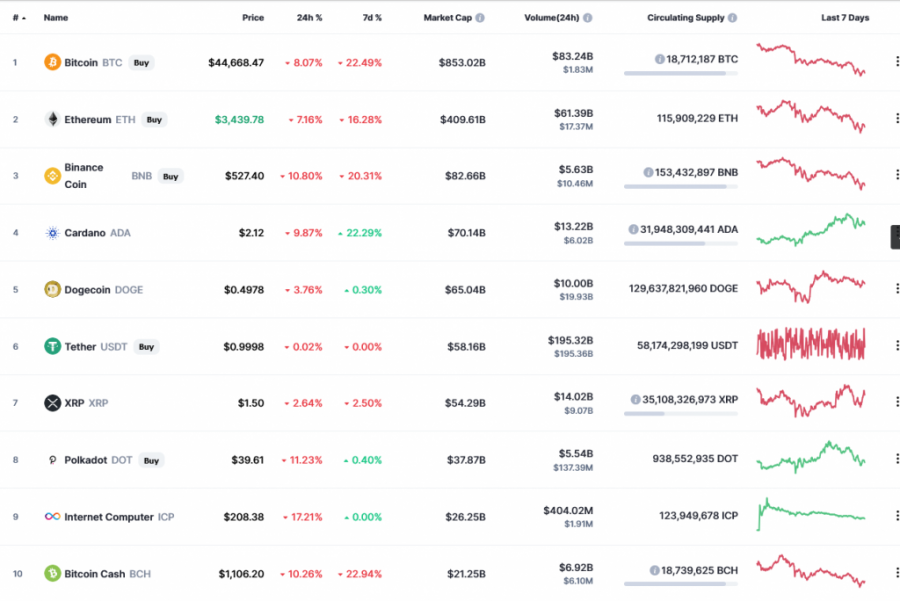

The news of Binance being investigated, has triggered the prices of popular digital currencies including Bitcoin, Bininace Coin, Ethereum (ETH, $3459.65, -7.8%), Cardano (ADA, $2.14, -8.62%), Dogecoin (DOGE, $0.5049, -2.46%), Tether (USDT, $0.9999, -0.04%), XRP (XRP, $1.52, -1.56%), Polkadot (DOT, $39.94, -10.38%), Internet Computer (ICP, $209.44, -19.39%), Bitcoin Cash (BCH, $1,116.77, -9.89%), Uniswap (UNI, $35.33, -8.58%), Litecoin (LTC, $289.60, -8.55%), Chainlink (LINK, $39.11, -10.21%), Stellar (XLM, $0.6962, -8.2%), USD Coin (USDC, $0.9998, -0.05%) and many others.

BNB/USD and BTC/USD price analysis

The price of Binance Coin has also declined from $684.14 to $486.00, indicating a decline of about 28.97%. At press time, BNB/USD is trading at about $525, with a market cap of nearly $80.359 billion and 24h trading volume of $3.820 billion (-32%).

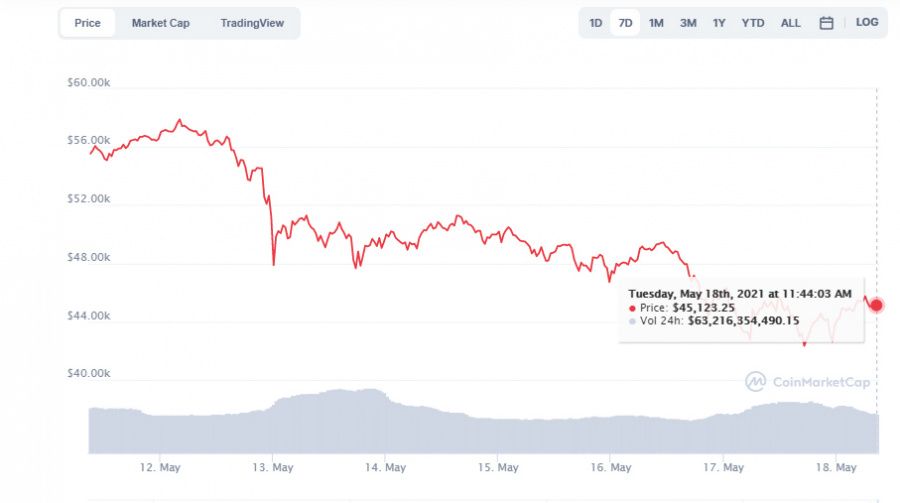

Bitcoin price has also fallen from $57,939.36 to $43,963.35, indicating a decline of 24%. Currently, BTC/USD price is changing hands at around $45,100, with a market cap of $844.279 billion and 24h trading volume of $63.184 billion (-22%).

The drop in the price of these cryptocurrencies being traded on the exchange in question could be that criminals including money launderers are fearing to currently associate with Binance because they can be caught offside during the ongoing investigations, arrested and charged in courts of law. What is not clear is whether the current bearish market is temporary or will last for a long time.

Source: Read Full Article