Is Bitcoin Boosted by Political Turmoil in the United States?

The world was watching yesterday as an angry mob stormed the United States Capitol building–the first time that the building had been breached by intruders in more than 200 years.

Twitter was abuzz with commentators on both sides of the ideological fight: some tweeting to condemn the rioters, and others cheering them on.

However, there was a third group of people that seemed to have something else on their minds: as the mob moved into the Capitol building, the price of Bitcoin reached past $37,000 for the first time ever.

US: "capitol hill has been taken over"

Bitcoin: 🚀🚀🚀— Annalese🐮 (@Annalese_BNT) January 6, 2021

A number of these Bitcoin enthusiasts seemed to be drawing a parallel between the violence unfolding on Capitol Hill and the rise in the price of BTC. However, the connection between these two events remains unclear. Was the new all-time high was somehow caused by the political unrest in the United States? Was the price boost was just a coincidence? Or were investors were betting that the drama would negatively impact the USD?

Was Bitcoin boosted by the riots on Capitol Hill?

The belief that Bitcoin was boosted by the protest seems to be connected with another belief that is widely popular in Bitcoin circles: a number of Bitcoiners believe that Bitcoin is increasingly seen as a hedge against economic uncertainty. (And, arguably, it is.)

If this is true, it would follow that Bitcoin may see a boost if the protests would have a lasting impact on the USD or the US economy.

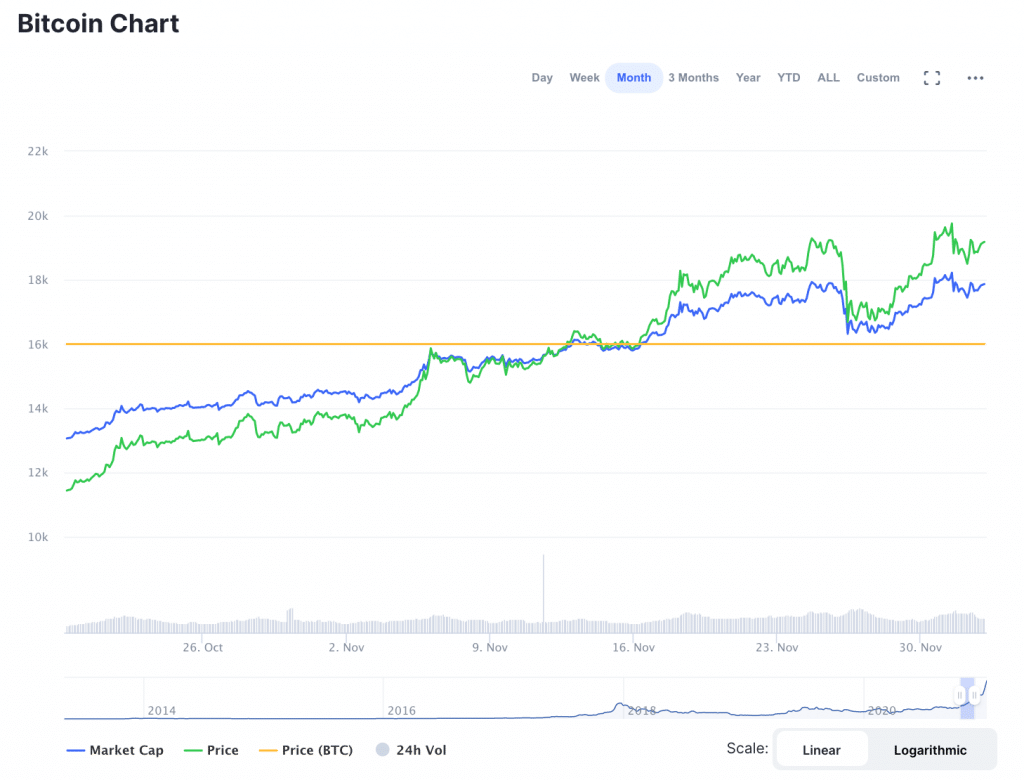

There is some historical evidence to suggest that economic and political drama in the US is “good” for Bitcoin. Take, for example, the week that followed election day in the United States. As Donald Trump’s campaign attempted to file lawsuits in states across the nation, it became increasingly clear that the election would be hotly contested.

At the time, Kadan Stadelmann, Chief Technology Officer of Komodo, told Finance Magnates that “given that there’s still a handful of states that are undecided in the presidential race, tensions are certainly high.”

And while “political uncertainty and economic uncertainty go hand in hand,” the price of Bitcoin seemed to react positively to what was happening in the United States: on November 3rd (the day that in-person ballots were cast), the price of Bitcoin was roughly $13,700. In the days and hours before the election was “called” on November 7th, Bitcoin had steadily risen, eventually passing $15,500.

Then again…

Of course, it’s also important to note that the price of Bitcoin really took off only after the results of the election were officially determined.

Between the 7th of November 2020 and the end of the month, the price of BTC exploded past $19,000. Additionally, it’s difficult to determine if BTC’s growth during the period from November 3rd to November 7th was directly related to the election drama at all–or, at least, to what degree the two were related.

In fact, some analysts argued that the price of Bitcoin was not reacting to the uncertainty of the election results, but rather the apparent certainty that Joseph Biden had, in fact, won the election.

On November 5th, Jeff Dorman, Chief Investment Officer at Arca, told Finance Magnates that “Markets hate uncertainty”–particularly when it comes to risk assets like Bitcoin.

“Therefore, anything that clears up uncertainty is viewed positively by markets. Most investors can deal with negative outcomes, but they struggle to deal with uncertain outcomes,” he said. At the time, the “uncertain outcome” was that of the election results; this time around, the uncertainty seems to be over whether or not the transition of power will be peaceful.

The USD seems to have taken the drama in stride

However, while BTC’s affinity for American political turmoil is still up for debate, there is increasing consensus that Bitcoin does seem to consistently be boosted by: a weakened USD.

Complete madness in the nation's capitol as bitcoin rips through $36,000. It's not about the price; it's about having a chaos hedge.

— Zack Voell (@zackvoell) January 6, 2021

Indeed, an increasing number of institutional investors have purchased BTC specifically as a “hedge” against inflation. One of the most notable examples of this is a letter that famed hedge fund investor Paul Tudor Jones wrote to his investors.

Jones specifically said that Bitcoin reminds him of gold in the 1970s, and that he sees Bitcoin as a hedge against inflation. He also said that given the current state of the United States’ monetary policy, inflation is an inevitability: “The best profit-maximizing strategy is to own the fastest horse,” he wrote. “If I am forced to forecast, my bet will be Bitcoin.”

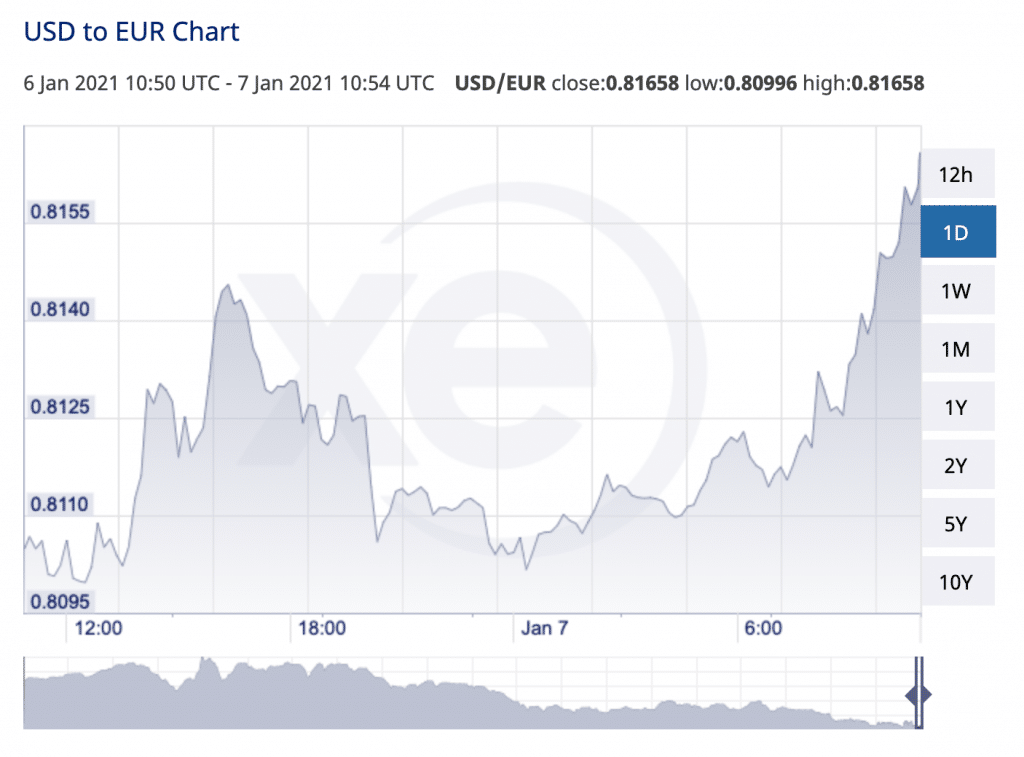

It’s important to note that the USD did not seem to suffer any major blows as a result of the riots on Capitol Hill. In fact, the opposite seems to be true: at press time, the USD was rising against the euro.

Fear of possible economic chaos is a strong motivator.

However, it’s quite possible that investors believed that it might–and that BTC received a boost as a result.

After all, fear of possible economic chaos is a strong motivator.

A similar phenomenon took place in early June of 2020, when political unrest in the United States seemed to coincide with a boost in the price of Bitcoin. Just three days into the month of June 2020, protests and unrest had unfolded across the country, sparked by the horrific murder of George Floyd.

Bitcoin, which had been struggling to sustain itself over the $10,000 mark, began to show signs of moving past $10K. At the time, Alex Mashinsky, chief executive and founder of Celsius network, told Finance Magnates that “news of riots and possible curfew in major cities [have] convinced many to buy coins.”

Additionally, Mathew Ficke, head of market development at cryptocurrency exchange OkCoin, said in a statement that noted that “BTC’s move back above $10,000 coincides with civil and economic unrest throughout the US.”

“Some argue the environment reminds the market that BTC can act as a hedge against excessive government influence. As equities are near pre-shelter-in-place levels, many seem to view crypto as relatively attractive,” he said.

Another example of this kind of phenomenon occurred when tensions arose between the United States and Iran at the beginning of 2020.

In addition to an increase in the price of BTC, data from Google Trends during the week ending on January 8th, 2020, showed that the search term “Bitcoin Iran” had spiked several times–by the end of the week, searches for “Bitcoin Iran” had risen a total of roughly 4,450%.

Similarly, when the protests over George Floyd’s murder took place in June, the number of searches for “Bitcoin protests” rose significantly.

This time around, the search terms “Bitcoin riots” and “Bitcoin protests” both showed spikes in activity on January 6th.

Further stimulus efforts may benefit American families in the short term, but could cause USD inflation in the long term

However, once the noise around the election certification and transition of power settles down, Bitcoin may still be in for further boosts.

This is due to the resumption of economic stimulus that’s widely believed to take place after President Biden steps into office and the Democratic majority takes hold of the Senate. On January 6th, future Senate Majority leader Chuck Schumer said that passing a bill to issue $2000 stimulus checks to the public is “one of the first things” he “want[s] to do.”

While millions of American families are in desperate need of relief from the economic stress brought about by the COVID-19 pandemic, a number of analysts have warned that continuing stimulus could eventually weaken the USD past the point of no return.

Indeed, before the election was called in November of 2020, Ulrik Lykke, Executive Director at cryptocurrency hedge fundARK36, told Finance Magnates that that macroeconomically speaking, “the issue of who will be the next President may not have as great of an impact on crypto as many expect,” told Finance Magnates.

After all, “Biden will likely continue the current administration’s policy of bringing more stimulus to the fragile economy, still suffering as a result of the COVID-19 pandemic.”

This appears to be the case. (After all, it was Donald Trump who initially proposed $2000 stimulus checks.)

Before the results of the election were called, Celsius Founder and Chief Executive, Alex Mashinsky also told Finance Magnates that any way you slice it, continuous government spending is a slippery slope: before the election was called, he said that “a Trump presidency would mean more tax cuts and bigger deficits, while Biden will bring more healthcare and social spending and bigger deficits.”

“Combine either with the Fed continuing to do whatever it takes to keep the safety net under the US economy, and you can see how a mountain of debt, greater than all the debt anyone had in history, will come bearing down on the US dollar.”

The future of the United States hangs in the balance

And indeed, it seems that this pressure on the USD–rather than any pressure that civil unrest could place on the dollar–is a larger threat to the status quo.

Alex Mashinsky explained that over the long term, continued spending could chip away at the Dollar’s position as the world’s most powerful currency.

“We may be able to hold back the debt for a while, but each passing day we deplete the trust the entire world has in the dollar and soon enough we will be left holding the bag with all these worthless dollars,” he said.

“While this may be good for Bitcoin and crypto, it is not good for democracy and for the world order as we know it.”

What do you think of the possible effects that civil unrest at the United States Capitol had on Bitcoin? What effects do you think that stimulus efforts will have on the future of the nation’s economy and on BTC? Let us know in the comment section.

Source: Read Full Article