The demonization of inflation

I have been in ‘this industry’ for a while, having worked on Wall Street firms for over 14 years and Bitcoin for seven years, so that statement can apply to financial engineering, trading systems, FX markets, or blockchains to all varying degrees. Long enough in all of these to have a unique insight into the current state of the ‘crypto’ or digital assets space. And boy, is it a crazy space. In many ways, it shares the same ‘locker room’ mentality that many trading floors on Wall Street exhibit, where testosterone, machismo, greed, and fear mix. But unlike those settings where everyone is generally ‘playing by the established rules,’ in digital currency, 98% of the participants actively find ways to circumvent them in the name of ‘disruption’ and ‘innovation.’ Most of them aren’t even aware of it. Such is the blindness caused by the ‘Innovator’s Dilemma.’

This is the reason why most mainstream people steer clear of digital currencies—and its more legal and mainstream sibling, digital assets. It is because they clearly see the pitfalls that the enthusiastic first movers in this industry are likely going to fall victim to. They tend to be overly skeptical, even adverse to the digital asset space. On the other end of the spectrum, the folks who don’t have any background in the financial industry, driven by the appeal of the ‘disruption’ culture of Silicon Valley, tend to be overly enthusiastic about the potentials of the technology. We see them jumping neck deep into their causes, some even changing their life views and philosophies based on its tenets.

Thus, because of my unique position of having lived in both worlds (finance and technology) I tend to sit in the middle, interested enough to tread lightly and carefully into the space. Believing in the true innovative potentials, but much slower and careful to avoid falling prey to the “disruption for disruptions’ sake” mind trap, the Bitcoin enthusiasts seem to find themselves entrapped.

It has certainly given me a unique perspective.

This perspective has allowed me to act as a ‘voice of reason’ many times when everyone else (with images of dollar signs or revolution burned into their retinas) seemed hell bent on committing their soul to the nouveau “just cause” of the month.

From someone with an outside perspective, it is certainly troubling to see how truly susceptible the general population is to the scourge of ‘brain rot.’ A collective term I give to memes/movements/ideas spread through the public psyche that is so clearly illogical or wrong, yet due to their appeal to superstition, greed, or fear, they tend to persist in the public mind and refuse to die.

One of these ‘brain rots’ is the topic of discussion this week: the age-old myths and untruths surrounding inflation.

“Inflation,” the word itself is smeared and evokes negative connotations among most people, but what is it, and why is it so bad? First off, the technical definition is a term overloaded even in the financial domain. Inflation refers to the general increase in the price of consumer goods and services measured over a yearly basis. It can also be used to describe the rise in the supply of money in the economy, most colloquially referred to as ‘money printing.’ One is actually the cause and the other the effect, but they are generally considered together as both are linked. Also, while too much inflation (in prices) is generally accepted to be bad (How is little Jimmy going to eat if momma isn’t able to afford his corn flakes?), too little inflation can be seen as bad as well.

How? Well, because inflation (in prices) is linked to GDP or the amount of production in an economy, and we generally want the economy to grow.

No inflation would mean no incentive or driving force to grow, as generally increasing prices, is an indicator of increased general demand in the economy. That there is more demand than the current supply can meet, which means more profits are being left on the table for the industries that can grow to earn it.

So, inflation is a complex term when seen from the eyes of prices. But what about the inflation of the money supply? Why is ‘printing money’ always bad? It isn’t really, though it is generally seen as bad when done by the government (note: NOT the same as the central bank), and handed over to the ‘special interests1.’ Money printing is an essential tool that the government can use to effect wealth redistribution and prevent excessive hoarding of wealth by the wealthy, leading to recession and depression in times of great shock—usually a period of excessive growth in supply. This is followed by a drastic drop in demand or sudden wealth redistribution due to excessive speculation2. Inflation essentially devalues the money equally across the economy and moves that value to those who receive the new money first. The value then trickles down through the economy (by changing hands through trade or investment), reducing in value until it stops and ends up saved in someone’s bank account as new money (through profits or wages).

Without going into the pros and cons of this mechanism, I recognize that it is generally accepted as a negative effect without agreeing or disagreeing.

But here is the interesting posit: Why is it that the same people who are so adamant against fiat currency inflation, such that they make it one of the primary reasons they are ‘in crypto,’ so flagrantly ignorant of the fact that it is the primary driver of value in Bitcoin and the whole digital currency industry?.

Yes, you read that right.

Inflation, the same demon, is the PRIMARY driver of value appreciation in the whole digital assets space. How?

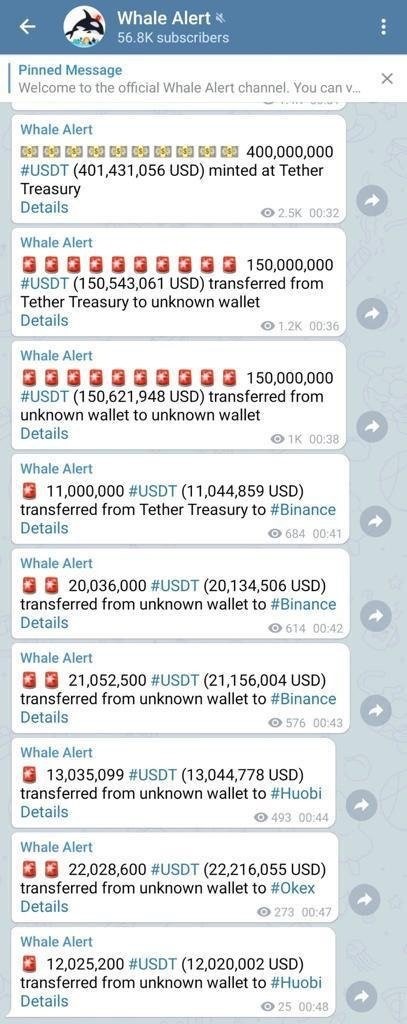

Tether, USDT, and its constant printing are the source of inflation3.

We are supposed to believe this printing is OK, but when the Fed does it, it is bad?

The only difference here is that the digital currency speculators (gamblers) in the market4, are the ones enjoying the effects of inflation. This is because the newly minted USDT goes straight to their associated digital currency exchanges and is used to buy BTC, pumping the asset’s price up and making (paper) gains for everyone who ‘aped5‘ into digital currency. So how does it finally feel to be on the beneficiary end of government corruption? Pretty sweet, huh? Not so much that inflation is a bad thing now, once you are the beneficiary, right?

This is the same as if the government printed money and then took that money and put it directly into buying up the stock market (of their favored darling highest campaign contributing companies, of course!). But, if this was a beneficial economic activity, why doesn’t the government do this all the time6?

The obvious (to outsiders) reason is that this activity does not result in sustainable economic growth.

The money put directly in the hands of speculative ventures removes a lot of the built-in and healthy behaviors of business leaders. Namely that they are risky, and they should spend their money wisely. There is a reason why the word ‘venture’ is called venture capital. It is a well-known effect that if one is suddenly left with a large sum of ‘no strings attached’ money, that person is apt to waste it on frivolous things.

“Easy come, easy go,” as the saying goes.

If the whole economy was suddenly given a lot of unearned capital, that would distort or even destroy the economy through hyperinflation. Demand would skyrocket, while supply falls, and worse, production capacity falls with it (why produce more to earn when you have someone giving it to you). For some reason, while this catastrophic scenario is an obvious reality in the real world to most people. Many don’t draw the same conclusions in the digital currency world, where inflation is tolerated as long as it is price inflation and not monetary base inflation. The dangers of this thinking is that as more and more people are drawn into a world where they cease being producers and become mere armchair speculators (consumers), the economy has an ever increasing risk of suffering a sudden shock that could lead to a catastrophic price collapse (when the music ends and the first start running for the exits). The idea that everyone will need to buy into the value proposition of a digital currency asset for you to have an opportunity to liquidate and cash out is the hidden catch. All the while, those who operate the Tether printing press continue to use their wealth redistribution mechanism to take money from elsewhere to line their own pockets. Unlike the real world, the money printed doesn’t even go to special interest groups or projects building infrastructure for the common good—it is used directly to enrich those who run the Tether mint and their friends, by buying up the fixed supply asset which they have convinced everyone else to overvalue. The only way out is to stop overvaluing it and be the first to the exits before the music stops.

Something to think about over the holiday season.

What do YOU value?

***

NOTES:

[1] I’ll leave this category open for your interpretation, as it is inevitably political. One man’s special interest is another man’s pork-barrel project. Candidates include, but are not limited to clean energy, global warming initiatives, gender studies, tobacco lobbies, pharmaceuticals, war on drugs, investment bank bailouts, housing loans, quantum computer research, etc.

[2] Just like the Great Depression was preceded by a huge multi-year boom in the economy and stock market. If this is starting to sound uncomfortable to you, perhaps you are in digital currency and you are starting to see the dangers of it.

[3] And until the folks at Tether open up their books to prove otherwise, it is the logical conclusion and most likely the truth.

To believe otherwise would be to think that 100s of millions of real money is being handed over to a shady company without any legitimate banking relationships to back the printing of new USDT. At the very least, if they are indeed backed at all, it is with shaky commercial paper from unknown companies of unknown creditworthiness. So its value is backed by DDD bonds at best, proceeds of crime at worst if backed at all!

[4] And let’s be honest, most people in Bitcoin are gamblers. There are only a few thousand actual builders.

[5] To borrow the apt term invented Bitcoin people to insult the public by showing them that they are too stupid to even know that they are being insulted.

[6] Theoretically speaking, of course. They can’t be pedantic because it is actually the central bank that controls this lever, and governments can only issue treasuries. So this sort of direct money printing isn’t possible.

Source: Read Full Article