Close Brothers H1 Profit Falls

Financial services business Close Brothers Group plc (CBG) on Tuesday reported a decline in profit before tax for the six months ended 31 January 2023, attributed mainly to the increased provisions in relation to Novitas.

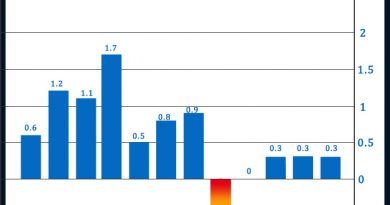

Operating profit before tax dropped to 11.7 million pounds, from 128.9 million pounds in the first half of the previous year.

Impairment losses on financial assets increased to 162.2 million pounds, from 48.3 million pounds in the previous year.

Adjusted operating profit decreased 90 percent 12.6 million pounds, from 129.8 million pounds in the previous period, mainly driven by higher impairment charges in relation to Novitas. Following a strategic review in July 2021, the company had decided to wind down Novitas, a provider of finance for the legal sector that it had acquired in 2017.

Profit after tax declined to 8.4 million pounds or 5.6 pence per share, from 95.1 million pounds or 63.0 pence per share in the first half of 2022.

Adjusted earnings per share stood at 6.1 pence per share versus 63.5 pence per share in the first half of the prior year.

Operating Income increased to 474.3 million pounds, from 471.6 million pounds in the first half of 2022.

Net interest income increased to 297.4 million pounds, from 291.8 million pounds in the year-ago period.

Non-interest income decreased to 176.9 million pounds, from 179.8 million pounds in the corresponding period of the previous year.

The group has also declared an interim dividend of 22.5 pence, versus 22.0 pence in the previous period, to be paid on April 26 to shareholders of record on March 24.

The CET1 capital ratio reduced from 14.6 percent to 14.0 percent, mainly driven by the impact of the IFRS 9 transitional arrangements and profits net of dividends paid and foreseen, partly offset by a decrease in risk weighted assets.

Shares of Close Brothers Group closed Monday’s trading at 1016 pence, down 61 pence or 5.66 percent from the previous close.

Source: Read Full Article