DeFi Project Spotlight: Ribbon Finance, the Options-Based Yield Generator

Key Takeaways

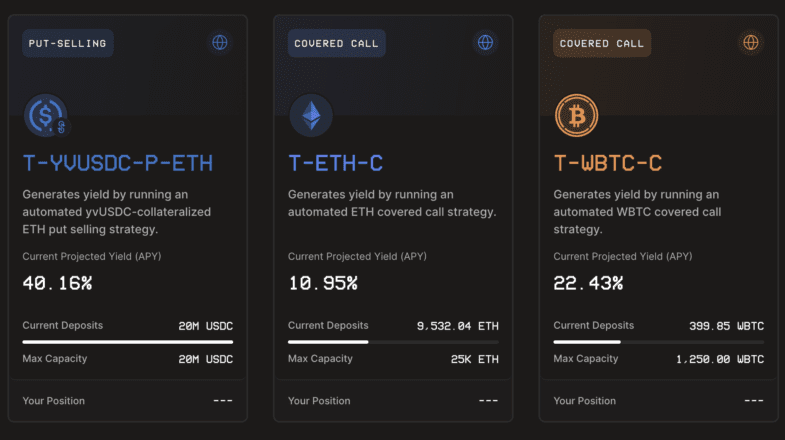

- Ribbon Finance offers option-based strategies on BTC, ETH, and USDC with some of the highest yields in DeFi.

- The higher rewards come with higher risk, as users can lose their capital if the market is too volatile.

- A new version of the protocol is scheduled to be released this month. A liquidity mining campaign and Balancer token offering are also due soon.

No yield farming, no impermanent loss, and unconstrained by market conditions: Ribbon Finance is building the Holy Grail for DeFi’s power users by offering sustainable high yields through options-based strategies.

What is Ribbon Finance?

Ribbon Finance started off the back of a problem.

After last year’s “DeFi summer,” decentralized finance has become known for offering three-figure yields that could make most TradFi veterans faint. However, these yields are generally not sustainable in the long term. They usually come from an activity known as yield farming, where new protocols distribute their tokens in exchange for liquidity. Yield farming is a great solution to boost early growth, but protocols can’t incentivize users forever.

Julian Koh, the CEO of Ribbon, says that options strategies are a way to capture sustainable high yields. He explains:

“Finding a sustainable source of yield is the bread and butter of Wall Street trading firms. People in DeFi want the high yields but the only way to do that sustainably is through options strategies.”

The options strategies Koh mentions are not extremely complex. They involve minting out of the money (OOTM) options and selling them for a profit. Ribbon automates this strategy so that users only need to put their assets in a vault and let the protocol do the rest.

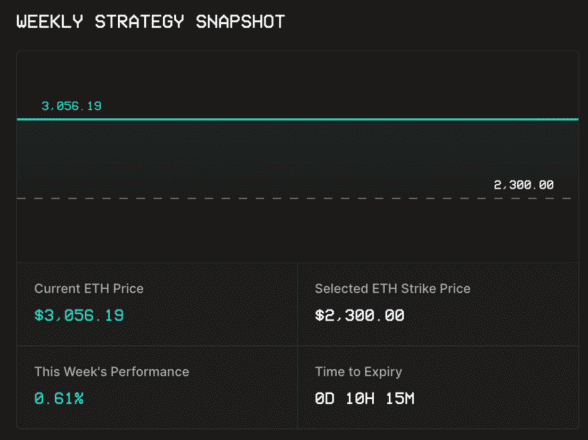

Each strategy slightly differs depending on the asset deposited. The USDC vault, for example, invites users to deposit USDC in the vault. Every week, the vault manager selects a price for ETH under its current market value and mints OOTM options to this selected strike price on Opyn. When other users or market makers buy the options, the vault manager redistributes the profit to the vault’s users. If the ETH price expires above the strike price, the users make a profit. If the option expires in the money, the option buyer can purchase ETH at the strike price, and the users lose some of their USDC.

Rather than distributing a governance token, Ribbon’s options strategies generate yield from other traders. There are no reasons for Ribbon to stop being profitable, even in a bear market. As long as there is a crypto options market, Ribbon will continue to function. Julian Koh also says that Ribbon can also scale beyond the on-chain market, explaining:

“Some people are worried we can’t scale because of the relatively small size of the on-chain options market, but we’re not constrained to the on-chain market. The whole crypto options market is our only bottleneck, but that’s far from where we’re standing. We work with market makers and professional options traders who can expand their trading 10x as well. The other side of the trade is large options trading firms who have a huge appetite.”

Leveraging Crypto Options

Ribbon’s vaults are essentially a short option against crypto volatility. By far, the worst performing week for Ribbon’s USDC vaults came when the entire crypto market suffered a dramatic crash in May. The vault’s users lost 15% of their funds as the price of ETH crashed well below the options’ strike price. Since then, it has recovered 11% in three months.

As long as the markets don’t experience the degree of volatility seen in May, Ribbon’s vaults should continue to prosper. The more mature the market, the better for Ribbon. At the moment, however, the crypto markets are still known for changing fast. Ribbon’s advantage is that a potential bear market wouldn’t affect its strategy.

Compared to other popular vault-based DeFi protocols, Ribbon’s strategy is unique. While their yields can be among the highest in DeFi, they come with risk. Sudden volatility can see users lose part of their investments. Koh says this is key to the strategy, though. He explains:

“When you look at Yearn Finance, they like to make vaults that only increase in value. That’s very comfy for their users, they don’t have to worry. Ribbon’s strategies have a higher risk, but higher rewards as well. Yearn will probably not expand to these riskier strategies as well, they’re mainly a yield farming aggregator. On the other hand, Ribbon uses financial engineering to create yield.”

Koh’s explanation highlights why Yearn Finance was happy to partner with Ribbon for its latest USDC-based options vault. In addition to the yield from the option strategy, depositors receive the yield Yearn offers to all USDC deposits. The two protocols don’t see their relationship as a rivalry. On the contrary, they decided to favor composability and build on top of each other.

At the moment, Ribbon’s options strategy doesn’t have direct concurrency. For Koh, the risk rather lies in copycats.

Ribbon’s Peculiar Token Launch

One of the most interesting points of Ribbon’s launch strategy was its token release. So far, 3% of RBN tokens have been distributed to early users of Ribbon’s vaults, and an extra 1% was distributed during a liquidity mining program in July. The catch, however, is that the token is hard-coded so it is not yet transferrable. There is no market for RBN, and as such, there is no price for it either. Explaining the decision to remove the ability to transfer the token, Koh says that the team wanted to reward “the right people” and incentivize those who supported the project early on. “We want to be community driven and get feedback from early users through governance. For that, we’re giving tokens to the right people in the early days,” he says.

Koh also says Ribbon will launch another liquidity mining program imminently, followed by a liquidity bootstrapping protocol on Balancer. The project is hoping for 10% of the tokens to go to “actual users” before trading launches.

Another peculiarity of Ribbon’s early days lied in its capped vaults. For most of the first few months after Ribbon’s launch, vaults were often full. This was done first to ensure the security of the vaults before too much ETH was deposited. The protocol received one audit, but Koh says that Ribbon wanted multiple audits before opening too much space.

This controlled growth has allowed Ribbon to test their market makers and options platforms to ensure everything works well before scaling. “It also generated a bit of FOMO,” Koh laughs. “People always saw the full vaults, so every time we opened more space, we had a lot of users rushing.”

The Next Steps for Ribbon

As Koh exclusively told Crypto Briefing, the next step for Ribbon is the release of a second version in the coming weeks. The code is ready and audited, and will be made available to the public after some internal testing. Koh says V2 isn’t a significant departure from V1, though. Ribbon’s next focus is composability—like the Yearn Finance partnership, and the support of new types of assets to the strategies (Ribbon currently supports BTC, ETH, and USDC). Koh says:

“Our current set of strategies is working really well, and options will be our main focus for the next six months. We’ll be doubling down on what’s working as we believe our vault can easily grow five to ten times in TVL. Other financial engineering ideas like fixed income, tranching, or other types of risk exchanges could be added on top of our current strategies.”

One of the most important changes will lie in the way vaults are managed. A human vault manager from Ribbon’s team is currently responsible for selecting the strike price. In V2, this could be changed to a completely automated system. The smart contract would decide itself what the strike price would be. For example, it could mint options 20% under or over the asset’s current price every week. Ribbon seeks to remove any human input from the functioning of the vaults.

The issue with Ribbon, at the moment, is that their vaults are a way to short volatility. This can feel like a losing strategy in bull markets like the one crypto is currently experiencing. Since Ribbon’s inception, two of the four vaults have yielded negative returns. The USDC vault lost a significant amount of value during the May crash and the WBTC vault, which runs a covered call strategy, suffered from Bitcoin’s sudden upward move in mid-July.

Ribbon has a very intriguing product, and its strategy is unusual. In DeFi, tokens are king. However, Ribbon refuses to let its products rely on tokens alone. The project goes as far as making these tokens untransferrable to avoid the kind of speculation we often see on the release of new tokens. This approach could be seen as Ribbon tying one hand to their back. The liquidity mining campaign saw vaults filling up, which hasn’t been the case since these incentives were removed and vaults caps were raised.

In reality, this shows that the Ribbon team is here to stay. If Ribbon’s team wanted quick, explosive growth, they could distribute their tokens at a faster rate. Their approach, especially in their token release schedule, shows a great deal of patience and care. In five years, protocols that distribute their token too quickly won’t have anything left to incentivize their communities. Ribbon is letting their products do the talking for them: no tricks, no yield farming, no incentives.

As Aave CEO Stani Kulechov remarked in a recent Crypto Briefing interview, the craze “will end at some point.” He said:

“Most of the liquidity mining incentives are copy-pasted from other notable projects and do not provide creative ways for communities to distribute token governance and let communities get more involved into the project.”

Ribbon has time firmly on its side. Its financial products are some of the most complex in DeFi, and they show the kind of patient approach to governance that suggests real care.

Disclaimer: The author held ETH and several other cryptocurrencies at the time of writing. The author also participated in Ribbon’s liquidity mining campaign.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article