‘Current bull run calls for caution’

‘It could tempt investors to pick stocks that are not fundamentally sound.’

Ashley Coutinho listens in.

The Business Standard BFSI Insight Summit saw some of the top mutual fund honchos come together for an evening of engaging discussion on some of the relevant issues facing the industry.

The first panel discussion got together six industry chiefs for a session on ‘Who Needs Mutual Funds?’ The topic has gained prominence given that several new investors in the past year have chosen to invest directly into equities rather than go through the mutual fund route.

The industry chiefs, however, cautioned that the new investors that had entered the market in the past year had seen only one side (half a cycle) of the market and their confidence could be misplaced.

Despite the immediate challenges in attracting new investors, especially the millennials who seemed to be more keen on do-it-yourself investing and unregulated products such as cryptocurrency, the road ahead for the industry looked promising, they said.

The panellists included A Balasubramanian, MD and CEO, Aditya Birla Sun Life AMC; Radhika Gupta, MD and CEO, Edelweiss Asset Management; Navneet Munot, MD and CEO, HDFC Asset Management Company; Kalpen Parekh, MD and CEO, DSP Investment Managers; Nilesh Shah, MD, Kotak Mahindra Asset Management Company; Vinay Tonse, MD and CEO, SBI Funds Management, the country’s largest fund house.

How have mutual funds grown as an investment vehicle?

Balasubramanian:

Mutual funds have gone through the journey of more than 23 years and have come a long way.

Mutual funds serve the common man. Every person in the country who has savings has to look at MFs as a vehicle for savings.

In the last few years, the awareness about MFs among investors has gone up significantly.

The increase in awareness and the size of the industry have resulted in MFs becoming a larger force in the development of the capital market in India.

MFs have helped channelise public savings in the equity market.

MFs are also playing a larger role in the development of the debt market.

There used to be a time when we used to worry about foreign portfolio investors (FPIs) being the dominant force in India.

When they come in, they come in with a big force.

When they go out, they go with a big force.

Fortunately, the Indian mutual fund industry has become one of the largest counterforces to foreign flows.

Munot:

Mutual funds can be used by anybody who is a saver and who needs to invest — whether it is to park funds for emergency needs, or for income generation or for long-term value creation.

MFs are highly regulated, extremely transparent and intensely scrutinised.

We perform an important role in the economy.

We are equally needed by the government, corporate sector and the household sector.

Diversification is the only free lunch available in investment and we are trying to provide that.

Parekh:

If you ask a barber: Who needs a haircut? He will say: “Everyone who has hair”.

Similarly, mutual funds are a vehicle to give access to anyone who has money and time horizon.

Whether it is a rich man, whether it is a corporation, bank treasury or a retail investor.

MFs offer a range of products from traditional equities, bonds, to commodities and international equities.

My driver has been working with me for 15 years.

Today, his daughter is getting enrolled in aeronautics engineering and a lot of her education has been funded by an SIP, which he had started around 12 years ago.

To an investor who believes in running a marathon and playing a Test match this is a beautiful product.

There has been a rush to invest directly during the pandemic instead of through the mutual funds. Do you see this as a challenge?

Balasubramanian:

In the last one year during the pandemic, everyone had enough time on their hands to up their learning curve and learn about stock market investing.

Unfortunately, we have seen only one side of the market in the last one-and-a-half years.

If somebody considers the up move seen in this period as permanent then they are mistaken.

MFs, on the other hand, have gone through many cycles, seen all the ups and downs that the market has to offer, and have emerged as one of the most trusted and reliable vehicles for investors in the country.

This is because of their transparency, high governance, efficient way of managing money and giving the best experienceto investors.

Tonse:

When I have direct equities giving me such good returns, why do I need mutual funds?

It’s all very well when the markets are going up.

The bulls may have been on a rampage for the last year-and-a-half, but that will not be the case all the time.

The confidence that investors have got by winning in some stocks could be misplaced.

The current bull run calls for caution as it could tempt investors to pick stocks that are not fundamentally sound.

Who doesn’t need mutual funds? If you look at the products and solutions that we offer, right from a novice to an evolved investor would do well to invest in mutual funds.

We are a nation of savers. The industry has done a wonderful job of converting savers into investors over the last many years.

Parekh:

No doubt the run rate of account opening has been higher for the broking industry in the past year.

But we can learn from that, how they have simplified their interfaces and become accessible to young investors.

But that is also an enabler for the growth of passive ETFs (exchange traded funds).

As more broking accounts open, these same investors will be able to open ETF accounts as well.

At 2 per cent penetration, the runway is long and I am confident that we will fulfil the diverse objectives of a diverse set of investors.

Munot:

While a large number of demat accounts have been opened, the recent trend is both a challenge and an opportunity.

If we can continue to focus on investor education and teach investors the importance of time, patience and discipline, and make a similar user interface available to investors as is available on broking apps, we will be able to attract investors.

In the September quarter alone 30 lakh (3 million) new folios got added, which shows that a large number of investors have come into the industry.

The largest asset manager in the world is BlackRock, which manages assets of over $10 trillion.

The largest bank in the world is not even half of its size.

The largest asset manager in India is Rs 6 trillion, while the largest Indian bank is six to seven times of that.

So you know where this industry is headed over the next several decades.

Some of the fintechs have started entering the mutual fund space. Do you perceive this as a threat?

Shah:

I have managed money for treasuries, family offices, high-net worth individuals and for urban India.

But I have to reach out to those investors in Bharat who have been cheated by collective investment schemes. They need my expertise and service.

I have to convert their savings into wealth.

The Indian MF industry has incredible talent for managing money.

Financial worries hurt everyone.

In some sense, we have to become the stress busters for our investors.

Today, 44 mutual funds collectively service about 30 million Indians, there are 300 million more Indians that we have to reach out to.

We are today urban-centric or probably top 30 city-centric.

We have to reach out to every PIN code of India.

Doing that will require a collective effort from all players.

So the more the number of players the better.

New fintech players and their digital technology will help us expand our distribution network and our investor reach manifold and that will help us grow and serve our customers.

Gupta:

If today some of the biggest names in fintech and other big business houses in India are choosing to enter the industry, that speaks volumes about our potential.

Mutual funds are a mass consumer product and the game is not in opening many accounts.

The success is in keeping people invested through cycles.

That is the battle we have to win.

How is the industry tapping the millennials?

Gupta:

We need to have products available digitally across platforms and service them digitally, which we have done to a large extent.

Millennials are savvy consumers and want products that are interesting and which they can touch and feel.

In the last one-and-a-half years, openness to experiment with new ideas has definitely gone up within the industry and we are finding new ways to connect with this group.

The post-Covid world has also given us many more communication formats — clubhouse, spaces, using influencers and social media.

We need to use these new media to reach out to millennials.

But the end objective should be to get them into the right products and make them stay across the cycle.

Munot:

We put all millennials in one basket.

But the millennial in Bihar may be very different from the one in Mumbai.

Millennials are often impatient, love trading and are influenced by social media.

To some, investment is just another form of entertainment.

But they have to realise that investment is very different from some of the things that they do in life.

It is more about patience and staying put for the longer term.

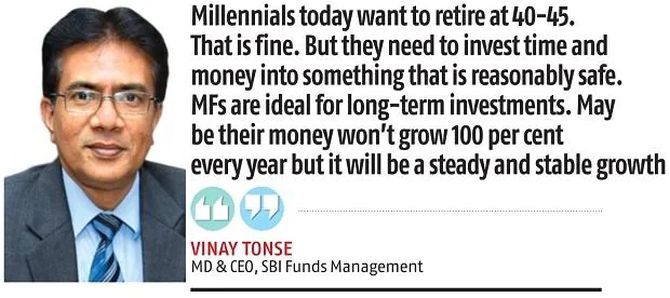

Tonse:

We need to educate them intensely about the dangers of wrong investing.

Fixed deposits have become boring for the millennials.

Routine investments have become boring.

They need newer and newer things. Millennials today want to retire at 40-45. That is fine.

But they need to invest time and money into something that is reasonably safe.

Start early, stay long and let the power of compounding kick in.

MFs are ideal for long-term investments.

Maybe their money won’t grow 100 per cent every year but it will be a steady and stable growth.

Shah:

Our investments will undoubtedly have to make money for the millennials.

But if we have to truly connect with them, we will have to impact the environment positively, impact society positively.

If we can be a true leader in impacting society and environment positively and establishing standards of governance, I’m sure we will be able to attract millennials to mutual funds.

Balasubramanian:

Millennials have aspirations and have to be shown how those can be fulfilled through mutual funds.

Most of them want to have fun while making investments even though investing is generally supposed to be something serious.

If you are able to combine the seriousness of investing with some kind of fun, we can attract them towards mutual funds.

International funds have been gaining currency among investors in the last two years. How do you view this trend?

Gupta:

International exposure is a must-have, but it should not be the first fund for any investor.

If you have to understand equity risk, you should understand it in your home market first.

After you have experienced domestic investing, international funds can add a lot of value.

Investing globally through MFs is a lot more convenient versus going through the LRS (Liberalised Remittance Scheme) route.

The cost of trading stocks, doing currency conversion, opening a brokerage account and doing individual stock picking makes direct investing more cumbersome than picking a mutual fund scheme that invests in international stocks.

Investors can choose from a variety of themes and regions for international investing.

Parekh:

Equity investing is about buying the best businesses in India and across the world.

Investors should ideally avoid an either, or approach and can look at building hybrid portfolios with a mix of domestic and international equities.

There are overseas companies that are growing at faster rates than that in India.

Countries go through cycles and building a multi-country portfolio can help reduce volatility.

What about the adoption of passive investment?

Shah:

You will invest in active funds only if the fund manager is adding value to you.

But you have to evaluate a fund manager on a long-term basis.

Let me illustrate this point with an example.

In 2017 a midcap IT company entered into a midcap index.

It entered at 1 per cent and at the end of 2017 became 4 per cent of the index.

Every single mutual fund manager decided to stay away from that company.

Throughout 2017, we were underperforming the index.

Today that stock is 90 per cent down from its top and we have been vindicated.

But if you had evaluated us, the whole of 2017, you would have said we are underperforming the index.

At the end of the day, my job is to serve my investors and create different products after defining the risk-return parameter.

Investors will hopefully select the right product after consulting an advisor or a distributor.

At some point in time, we will also see the development of wrappers in India where we will provide tailor-made solutions to conservative and aggressive investors.

Either you’ll have a readymade asset allocation available through a wrapper product or you will choose the services of a distributor or a registered investment adviser to create a tailor-made portfolio.

Your portfolio will be complete — domestic or local, active or passive– depending on your need.

Tonse:

I am fine with the growth of passives in India.

But too many funds are funnelling their money in a few stocks.

Stock markets are a barometer of the economy.

And I would like the passive money going into a broader index of 200 to 500 stocks instead of just the top 50.

Source: Read Full Article