Crypto Briefing's CB10 Index Makes Room for ETH, ADA

Key Takeaways

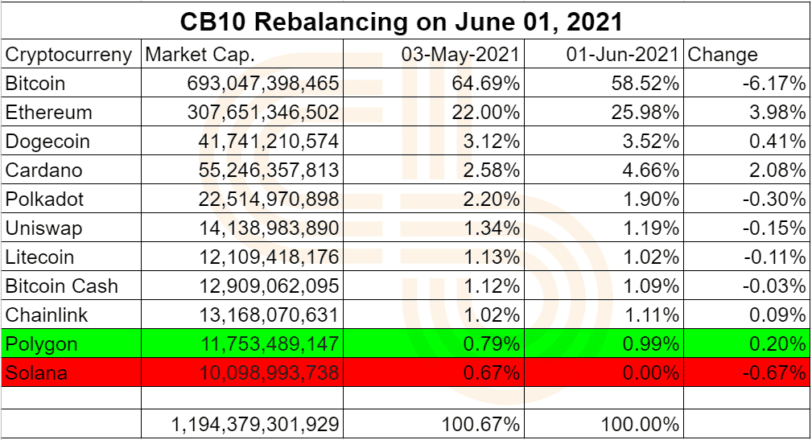

- The June rebalancing of Crypto Briefing’s CB10 was performed at 10:00 AM EST on Jun. 1.

- Cardano, Dogecoin and Ethereum were the top performers of the index last month.

- Polygon’s MATIC replaced Solana with a 0.99% allocation.

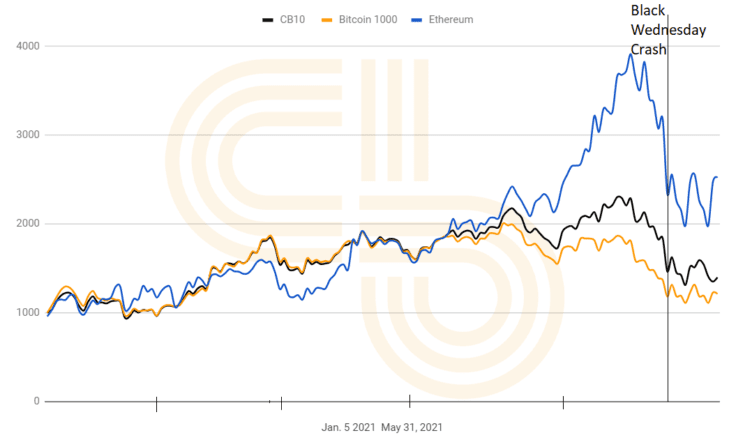

Crypto Briefing’s CB10 index of the top ten cryptocurrencies weighted by market capitalization yielded a negative return of 27.6% in May.

CB10 May Performance

Crypto Briefing’s CB10 index steered through the turbulent May period with higher gains than Bitcoin. While Bitcoin registered a monthly loss of 35.5%, CB10 dipped 27.6%.

The index borrows from the principles of the S&P 500 to distribute funds based on their market capitalization. The distribution enables lower volatility for CB10 and an improved risk-return ratio.

Cardano’s native token ADA was the top performer among CB10 tokens last month. While most tokens ended May in red, ADA’s monthly gain was 28.5%. The anticipation of an upgrade to bring smart contracts to Cardano fared well for its price.

DOGE and ETH contained their monthly losses at 6.5% and 10.5% respectively. On-chain statistics, the strengthening DeFi narrative, and growing institutional interest have all fueled overwhelmingly bullish sentiments for ETH in recent months.

Moreover, the community engagement around Dogecoin has been highly active, helped in part by Elon Musk’s promises of improving the source code and occasional promotional tweets. DOGE was among the top performers during last month’s crash.

The monthly losses in Bitcoin and many other cryptocurrencies were greater than 30%.

Bitcoin Dominance Slides

The most notable trend in May was the strong correction in crypto markets, commencing May 12. In addition to the Bitcoin dip, many DeFi tokens and lower cap coins suffered losses of 50% or more after the market crashed on May 19.

Bitcoin’s market cap dominance slid below 50% for the first time since 2018. On May 19, there was a brief surge in dominance. Nevertheless, the rotation back to Bitcoin was limited following the crash. Currently, BTC holds 40.2% of crypto’s $1.73 trillion market cap.

Ethereum’s share of the crypto market increased to 18.1% with a total market value of $313 billion.

The Rebalancing

The portfolio rebalancing was performed at 10:00 EST on Jun. 1, 2021.

The composition of the index changed primarily for the top four cryptocurrencies. Once again, Ethereum took a significant portion of Bitcoin’s share in the index.

Bitcoin’s percentage weight dropped from 64.69% to 58.52%, while ETH, DOGE, and ADA saw increased allocations of 3.98%, 0.41%, and 2.08% respectively.

Polygon’s MATIC made its debut entry in the index, replacing SOL at the tenth position. Its share at the time of rebalancing the index was 0.99%.

Investors can sell their tokens for a stablecoin or Bitcoin and buyback newly allocated amounts to rebalance the index. The details of the process are listed in the first portfolio rebalancing in February.

Last but not least, it’s worth noting that the compounded strategy may not appeal to all readers.

Indices based on strategies like distribution by market capitalization or segments are effective mediums for passive investors. They improve the risk-return ratio by diversification. However, the investors must also have an exit strategy for their investments. They can choose between booking profits every month (or even the quarter), or continue compounding the gains.

For instance, if investors who had started with $1,000 in January took out their gains during each month’s rebalancing, they would have added $800 in the first four months. Accounting for May’s 27.5% loss, the total profit in five months comes to $525. The compounded return figure for the same period is $493. Thus, while compounding yields superior returns during positive trends, it might not be suitable for volatile markets.

For experimental purposes, Crypto Briefing will continue to follow the compounded strategy. Find live portfolio stats here.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article